Whether your parents taught you, you learned it in school, or you are self-taught, making a budget is an important life skill to have. Making a budget presents its challenges, and if you’ve never done it before, it can feel almost impossible to do.

Luckily, you don’t have to make a budget all by yourself. There are a variety of tools, worksheets, checklists, and professional help that can make budgeting very easy to do. We’ve gathered some of the best tools around for your budgeting needs.

Pioneer’s Money Management

An extremely powerful tool for creating and managing your budget is the myPioneer Money Management tool. Especially if you need to track your purchases and don’t feel like holding onto your receipts and putting them into a spreadsheet, this tool is for you. By categorizing and tracking purchases made with your Pioneer debit and credit cards, along with any checks or transfers you make, you can get a comprehensive look at both your spending and income. You can even add accounts from other financial institutions to track, not just your Pioneer accounts.

An extremely powerful tool for creating and managing your budget is the myPioneer Money Management tool. Especially if you need to track your purchases and don’t feel like holding onto your receipts and putting them into a spreadsheet, this tool is for you. By categorizing and tracking purchases made with your Pioneer debit and credit cards, along with any checks or transfers you make, you can get a comprehensive look at both your spending and income. You can even add accounts from other financial institutions to track, not just your Pioneer accounts.

You can create a full budget within the Money Management tool. See how much you’ve spent in previous months, set goals for financial spending, and track your current progress. You can even set up goals for individual areas, like for eating out or buying luxury items to help keep you focused and honest.

Worried about overspending? Create alerts to let you know when you are close to your budgeted limit for a certain category, or in total, and send another alert when you hit or go over. Another type of alert you can set up is whenever a large transaction happens, you get notified. Very useful for making sure you don’t overdraft after paying off some big bills and a great way to get notified if your accounts are compromised and somebody is stealing your money.

If you are already a Pioneer member, just log in to your myPioneer account and click on Budget Manager (or Money Management on the myPioneer app) to get started. If you aren’t a Pioneer member, join today and then get using Budget Manager, along with all of the other benefits membership entails.

Mint and other Budgeting Apps

Pioneer’s Budget Manager isn’t the only budgeting application around and many of those on the market can do great things. A very popular app is Mint, a free budgeting app that can help you set up and control your budget. It can sync with your bank and credit card accounts to track your purchases, help you set limits on different categories of expenses, and even track your bills and alert you of any unexpected changes.

Pioneer’s Budget Manager isn’t the only budgeting application around and many of those on the market can do great things. A very popular app is Mint, a free budgeting app that can help you set up and control your budget. It can sync with your bank and credit card accounts to track your purchases, help you set limits on different categories of expenses, and even track your bills and alert you of any unexpected changes.

Other budgeting apps, like Quicken or You Need A Budget, can do a lot of the same stuff as Mint and Pioneer’s Money Management tool. The downside of other budgeting apps though is that they either cost money, or are free but filled with ads. Pioneer’s budgeting tool is free for members and has no ads, giving you the best of both worlds.

Talk with a Trained Specialist

You aren’t alone when it comes to building a budget. If you need help figuring it all out, you can ask for help, and we know just the people you should talk to. Pioneer partners with GreenPath Financial Wellness to provide our members expert financial advice.

Whether you need help with constructing a budget, consolidating debt, or just help with other financial aspects, you can turn to GreenPath for help. They can provide materials to help you get started, tell you what information you need, and sit down with you to build your own personal budget.

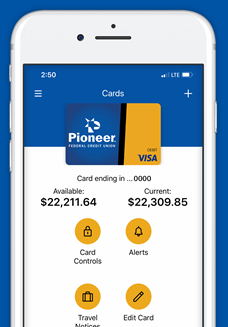

Card Companion App

Do you feel like you have a hard time with self-control and spending money when you shouldn’t? We’ve got an app for you!

Do you feel like you have a hard time with self-control and spending money when you shouldn’t? We’ve got an app for you!

The Pioneer Card Companion app gives you more control on how you use your Pioneer debit or credit card, like being able to pause it if you misplace your card, or receive notifications if your card is used outside your normal state. But there are two big functions that will interest impulse shoppers.

The first feature is being able to set a transaction limit for your card, to help prevent overspending at a store. Only going for one item at a store? Set your card’s limit to just include that one item and will decline your card if you go over.

The second feature is being able to decline using your card for online purchases. It’s incredibly easy to buy things on Amazon and other online retailers with the “Buy with one click” buttons and options, so by setting your card in the app to stop any online purchases, you slow down your buying process. That can give you some extra time to really think if that purchase is needed and how it fits in your budget.

Download the Pioneer Card Companion today for more control on your card and to be able to set limits for yourself so you can stay on budget!